Multifamily Investment Analysis

Evaluate multifamily investments using your numbers. Use our proven Excel cash flow model to discover pricing, financing capacity, and projected returns across multiple scenarios in minutes.

Designed for simplicity, using the same industry standards used by lenders, brokers, and investors of multifamily real estate. Get meaningful underwriting outputs, without devoting time to cumbersome Argus runs.

A trusted Excel model you can use today—and keep forever.

Not a Course. Not a Subscription. Not a Coaching Program.

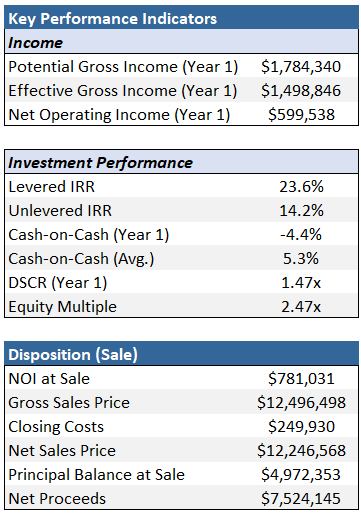

Efficiently model Potential and Effective Gross Income, Pro Forma NOI, Debt Service, DSCR, Debt Yield, Net Effective Rent, Exit Value, Equity Multiple, and more.

Whether you’re underwriting your first multifamily deal or comparing multiple acquisition opportunities, this model helps you:

Underwrite multifamily assets using rent, expense, financing, and exit assumptions

Run cap rate sensitivity analysis

Adjust occupancy, rent growth, OpEx, CapEx, and financing terms

View monthly and annual cash flow outputs

Compare key return metrics, including unlevered and levered IRR

Understand pricing and affordability before submitting an offer

Try our free DSCR calculator to quickly test multifamily loan feasibility.

No macros. No circular references. No jumping between endless input tabs. It’s underwriting and cash flow modeling made simple and repeatable!

Avoid costly mistakes, save money on consultants, and walk into negotiations knowing the critical numbers from every scenario you can think up.

-

Then this is designed for you! All input fields are clearly labeled (blue), outputs are locked (black), and the accompanying guide walks you through each section—no advanced Excel skills needed. All inputs are located on a single tab.

-

The Excel model and PDF guide will be delivered in a zip folder to the email address you provide at checkout.

-

Then this will feel refreshingly efficient. The model isn’t trying to be a 1,000-input institutional tool. It’s designed so that the actual levers that move multifamily valuations and investor returns are the focus. Experienced users usually end up adopting this as their day-to-day underwriting model because it’s faster to use, easier to explain to partners, and simple to iterate when assumptions change. If you’re underwriting regularly, the time savings alone covers the cost almost immediately.

-

Minor updates and patches are free for existing customers. Just submit your prior purchase details through the Support page and you’ll receive the latest version. Major upgrades (e.g., v1 → v2) are treated as new products and will require a new purchase.

-

The model is intentionally simple and intuitive to level the playing field between Excel wizards and beginners. Most people are underwriting deals within 15–30 minutes. The guide is always available for you to reference.

-

Not in this version. This model calculates total deal returns (levered and unlevered). A future package will include GP/LP waterfalls, preferred return structures, and promote tiers. So stay tuned!

-

In general, yes. It is intended for investors analyzing and underwriting potential acquisitions, or evaluating the performance and modeling the exit scenarios of their existing assets. Future models will include these components. However, it would be a great model for a stabilized property’s performance.

-

Yes. The layout is clean and professional. Many users share the summary outputs directly when discussing deals with lenders, brokers, partners, and LPs.

-

The guide provides definitions of the model’s inputs, how those inputs impact the cash flows and returns, and what’s considered reasonable or industry standard when it comes to multifamily investment analysis.

Questions about the model

Evaluate multifamily deals in minutes!

Don’t spend hundreds on institution-level models that are unwieldy and have more inputs than you’ll ever need. And definitely don’t spend thousands on courses or coaching.

For one flat price, you’ll receive a plug-and-play cash flow model and a handy PDF walkthrough guide, designed for intuitive use by anyone. Find out more here, or check out the YouTube channel for walkthroughs. If you want to understand how we think about underwriting multifamily deals, that framework is laid out here.

Use promo code NEWYEAR20 for $20 off your purchase for a limited time.